Navigating CBDCs

Charting the Evolution of Digital National Currencies

Central Bank Digital Currencies

Monerex CBDC Integration

Central Bank Digital Currencies (CBDCs) represent the next monumental shift in the world of finance. As digital renditions of a country’s national currency, CBDCs are issued and regulated by central banks, combining the convenience of digital currencies with the reliability and trustworthiness of conventional financial systems. Monerex, at the forefront of financial innovation, envisions a seamless integration of CBDCs into its platform. Our goal is to bridge the gap between traditional banking and the burgeoning world of digital finance, ensuring our users enjoy the best of both worlds. Dive into the future with Monerex, as we chart the course for a new age of financial inclusivity and digital empowerment.

Global interoperability

ISO 20022: Standardizing Monerex's Approach to CBDCs

ISO 20022 stands as a universal financial industry messaging standard, designed to bolster the efficiency and clarity of cross-border payments and other financial communications. By adhering to this global standard, systems can achieve optimal interoperability and seamless financial dialogue. The XRPL, upon which Monerex is built, is ISO 20022-compliant, offering unparalleled security, scalability, and interoperability.

For Monerex, ISO 20022 represents an essential foundation for integrating CBDCs (Central Bank Digital Currencies) into its platform. By aligning with this standard, Monerex ensures that its CBDC-related services and offerings are in sync with global best practices and can easily interface with other systems that use the same standard, paving the way for smoother transactions and broader acceptance.

Future Horizons

Trust and Confidence

One of the foremost reasons for CBDC regulatory compliance is to establish trust and confidence among users. CBDCs are issued and regulated by central banks, institutions known for their stability and credibility. Users expect the same level of security and regulation when interacting with CBDCs through payment apps. Compliance with CBDC regulations ensures that Monerex aligns with established financial standards, reassuring users of the app’s reliability.

Interoperability and Inclusion

As CBDCs are standardized digital representations of a country’s official currency, they naturally bring about a higher degree of interoperability between different financial systems. This not only simplifies trade and investment on a global scale but also fosters financial inclusion. Many unbanked or underbanked populations can benefit from easier access to financial services through platforms like Monerex. By integrating CBDCs, Monerex can tap into a broader audience, ensuring that even those without traditional bank accounts can participate in the modern digital economy.

Liquidity and Efficiency

The integration of CBDCs within platforms like Monerex ensures greater liquidity and enhanced transactional efficiency. Central Bank Digital Currencies provide a seamless bridge between traditional fiat currencies and digital assets. By enabling swift conversions and transfers, CBDCs streamline cross-border transactions and reduce potential friction points, making global trades quicker and more cost-effective. For platforms like Monerex, embracing CBDCs means not only staying ahead in the fintech race but also providing users with top-tier, efficient financial tools.

Real-time Reporting

Monerex offers real-time transaction reporting and auditing capabilities. This transparency ensures that all transactions conducted through the app are compliant with CBDC regulations and can be easily monitored by relevant authorities. In an era where CBDCs are poised to revolutionize the financial landscape, adherence to CBDC regulatory compliance is not just advantageous but imperative for payment applications like Monerex. Compliance fosters trust, aligns with legal frameworks, and mitigates risks, ultimately ensuring the long-term viability and success of the Monerex Protocol.

Global Adoption

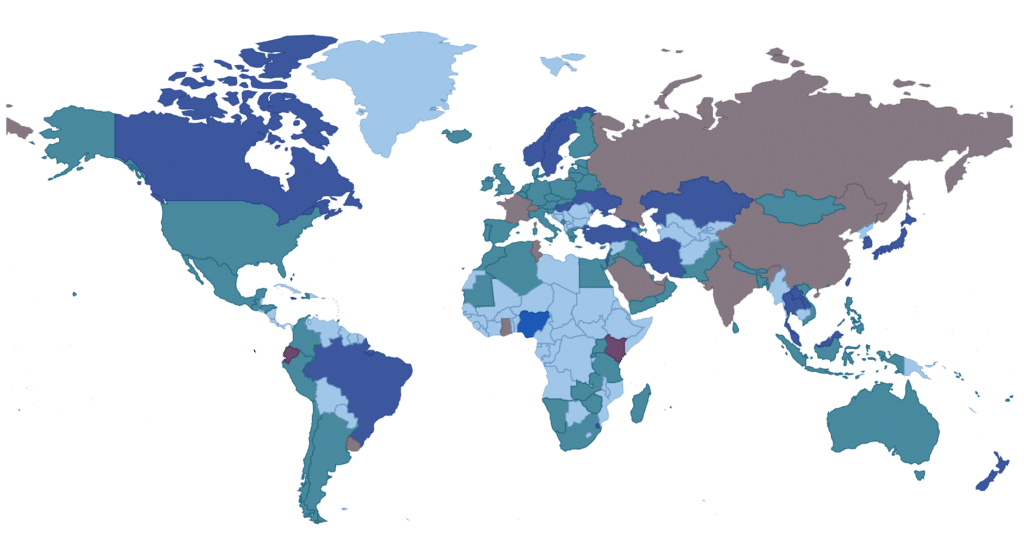

The global landscape is witnessing an accelerating shift towards the adoption of Central Bank Digital Currencies (CBDCs). Numerous countries are either piloting, researching, or actively implementing their own CBDCs, recognizing their potential to modernize financial systems, enhance cross-border transactions, and strengthen monetary sovereignty.

Current Status of Central Bank Digital Currencies

Today’s Central Bank Digital Currencies Status, https://cbdctracker.org/

FAQs

Central Bank Digital Currencies (CBDCs) are digital forms of a country's official currency, issued and regulated by its central bank. They aim to offer the convenience of digital currencies while maintaining the security and regulation of traditional banking systems.

ISO 20022 is a universal financial industry messaging standard adopted globally to enhance and streamline cross-border payments, securities transactions, and other financial communication processes. It provides a common platform for the development of messages using a standardized methodology, process, and repository.

As CBDCs become more prevalent, having a universal messaging standard like ISO 20022 ensures efficient communication between different financial entities and systems. It fosters smoother transactions and broader acceptance of CBDCs.

Yes, the XRPL has recognized the importance of the ISO 20022 standard and has ensured compatibility to foster efficient communication with different financial entities that use this standard.

Monerex's integration ensures users can transact with CBDCs on a secure, scalable, and interoperable platform. This integration aligns with global financial standards, offering users the confidence in the app's reliability.

Monerex adheres to CBDC regulatory compliance, aligning with established financial standards. It offers real-time transaction reporting and auditing capabilities, ensuring all transactions are compliant and can be monitored by relevant authorities.

Latin America’s Premier Digital Asset Management Solution

Quicklinks

Copyright © 2025 | MONEREX INTERNATIONAL SA DE CV